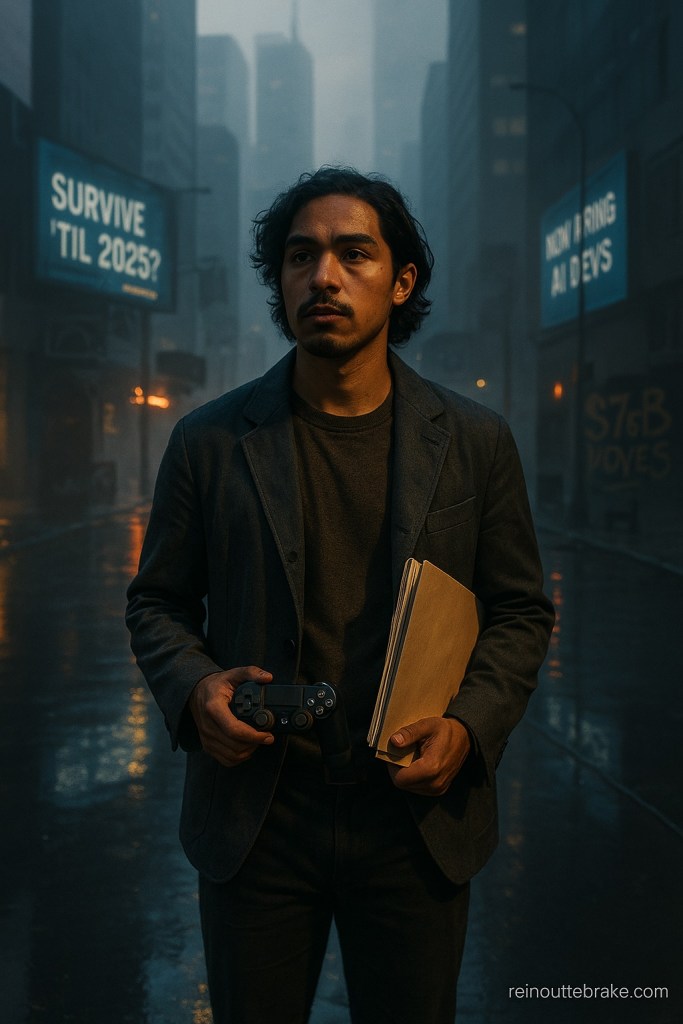

They said 2024 would be about one thing: “Survive ‘til 2025.”

For many studios, that wasn’t just a catchphrase — it was a cliff’s edge. Layoffs, burnouts, and cautious capital defined the year. But in a striking reversal, Q1 2025 delivered what may be the industry’s most hopeful quarter in over two years.

According to DDM’s data, the first three months of 2025 saw a combined $7.8 billion in game investments and M&A activity — the largest total since Q4 2023. While the volume of deals barely budged, value surged by +29%.

So what changed?

The short answer: confidence returned — especially in AI, blockchain, and game developers with proven momentum. The longer answer reveals a shift in how money moves, what investors now prioritize, and why this quarter may be a turning point, not a one-off.

Let’s break down the numbers — and what they signal for the rest of 2025.

The AI and Developer Deal Boom: Confidence Is Back — Selectively

If Q1 2025 had a headline within the headline, it would be this: AI and core developers are back in the spotlight — and back in the money.

“This isn’t scattershot investing. It’s a high-conviction vote for what’s next.”

Investments soared to $4.4 billion across 190 deals — a staggering +370% jump in value compared to Q4 2024, even as volume slipped slightly. It marks the biggest quarter since Q2 2022 and suggests a shift from broad speculation to laser-focused conviction.

Read also: From $80 Games to $5B Hits: Inside Gaming’s Turbulent Transformation in May 2025

At the center of this was Infinite Reality’s $3.0 billion raise, backed by Sterling Select, which made up 67% of Q1’s total investment value. But the story didn’t end with one mega-deal.

Game developers alone brought in $4.0 billion across 103 deals, showing a +457% increase in value, even as deal volume fell by 27%. The signal? Investors are doubling down on quality, not quantity.

AI Investment Surges Past Expectations

In perhaps the most defining stat of the quarter, AI-related game investments totaled $3.1 billion across 32 deals — up an eye-popping +2,288% in value quarter-over-quarter.

These deals aren’t just buzzword-chasing. They reflect.

- A shift toward AI-assisted game development and personalization

- The rising value of AI-driven infrastructure (from NPC behavior to player onboarding)

- Broader VC enthusiasm for AI startups as ecosystem enablers

This isn’t about future promise anymore. Investors clearly believe AI is already reshaping pipelines and play patterns.

Blockchain Gaming: Fewer Deals, Bigger Bets

While blockchain gaming saw deal volume cut in half (-50%), total investment value jumped +74% to $372.2 million across 28 deals. The interpretation is nuanced: investor enthusiasm hasn’t vanished — it’s matured.

Fewer early-stage token plays. More focus on:

- Studios with shipping products or loyal user bases

- Infrastructure firms bridging Web2 and Web3

- Hybrid monetization models (game-first, crypto-optional)

The data leans toward a real but selective resurgence. AI, trusted developers, and scaled tech platforms are commanding serious capital. Risky or early-stage outliers? Not so much.

Read also: April 2025’s Gaming Shake Up: Why Mobile Is Booming, London Is Rising, and Cross-Play Is Winning

M&A Moves: Quiet Volume, Loud Intentions

Mergers and acquisitions in Q1 2025 didn’t just rebound — they redefined where value is being reshaped in gaming.

While total M&A value dropped -34% to $3.3 billion, the volume of deals surged +53% to 55 transactions — the highest since Q4 2022. At first glance, that might seem contradictory. But zoom in, and a different picture emerges.

“More deals. Lower prices. Higher urgency.”

44 of the 55 M&A deals were undisclosed — representing 80% of total volume. That alone reveals a key undercurrent: studios are being acquired more quietly, and often more cheaply, as founders recalibrate or exit under pressure.

Mobile Is Still the M&A Magnet

The largest M&A segment by value? Mobile, taking up 63% of deal value, followed by console/PC at 36%. MCGs (mass community games) and esports made up less than 1%, showing their current lull in strategic buyouts.

Why mobile? Two reasons:

- Continued consolidation among mobile publishers and tool providers

- A maturing monetization ecosystem that’s still more predictable than premium/console pipelines

A Global Power Play

Geographically, M&A activity was surprisingly balanced:

- Asia led in value with $1.3 billion across 7 deals

- Europe dominated in volume: $1.2 billion across 22 deals

- North America contributed 38% of total volume, though many values remain undisclosed

While North America remains the innovation hub, the money — and mergers — are flowing more globally than ever before.

Strategic, Not Speculative

The spike in M&A volume isn’t about frothy enthusiasm. It’s strategic repositioning. Studios with solid IP, tech platforms, or loyal audiences are being folded into larger ecosystems before valuations rise again.

And for those with shaky financials post-2024? The exit window is now — or never.

Follow the Money: $21.8B in New Funds Signals a Strategic Reset

Perhaps the most quietly powerful data point of Q1 2025? Not the deals themselves — but the capital lining up behind the next ones.

“Money doesn’t move without intent. And right now, it’s moving toward AI, infrastructure, and early-stage conviction.”

$21.8 billion was raised across 43 new funds — a +122% increase in value and the largest fundraising quarter since Q2 2022. That includes both venture capital and strategic funds targeting the gaming sector and adjacent tech.

Read also: What April’s Biggest Releases and Industry Moves Reveal About Gaming’s Future

The Heavyweights Behind the Surge

Just five institutions made up 65% of the capital raised:

- Bank of China – $6.9B

- Khosla Ventures – $3.5B

- Thoma Bravo – $1.9B

- Haun Ventures – $1.0B

- Government of India – $1.0B

This blend of state-backed and elite private capital signals something rare: alignment across governments and top-tier firms around the future of digital entertainment, infrastructure, and AI tooling.

Early-Stage Bets Are Back in Fashion

Breakdown by fund stage focus:

- Early-stage: $10.9B (28 funds)

- Stage-agnostic: $8.8B (13 funds)

- Mid/Late-stage: $2.1B (2 funds)

Despite 2024’s risk aversion, 2025 is already showing signs of renewed faith in early innovation — especially in AI and immersive infrastructure.

Notably:

- AI-focused funds raised $5.2B across 15 funds

- Blockchain-focused funds raised $2.1B across 8 funds

Investors aren’t chasing hype. They’re recalibrating around core shifts in how games are built, discovered, and monetized.

Capital Is Selective, Not Scarce

Just because there’s more money doesn’t mean it’s flowing freely. DDM’s tracking — which only includes closed deals, not announced ones — confirms this. Every number reflects a transaction that actually happened.

That’s what makes the Q1 surge even more significant: it’s real capital, real conviction, and a real directional signal.

A Quarter of Quiet Conviction

In a post-survival industry, Q1 2025 didn’t scream recovery — it whispered it with precision.

From the outside, it might look like a few mega-deals distorted the numbers. But underneath, a clear signal emerged: capital is flowing again — not blindly, but with focus.

- AI is no longer a side bet — it’s central to how games will be built and played.

- Game developers with strong traction are being rewarded with record-setting raises.

- M&A is accelerating, but not loudly — value is being repositioned behind the scenes.

- And new funds, especially early-stage, are lining up to shape what comes next.

The game industry isn’t “back” in the old sense. It’s becoming something new — leaner, smarter, and more tightly aligned with long-term tech and consumer shifts.

The survival era may be ending — but the reinvention era is just beginning.

What do you think? Are we witnessing a true turnaround — or just a strategic pause before the next wave hits?