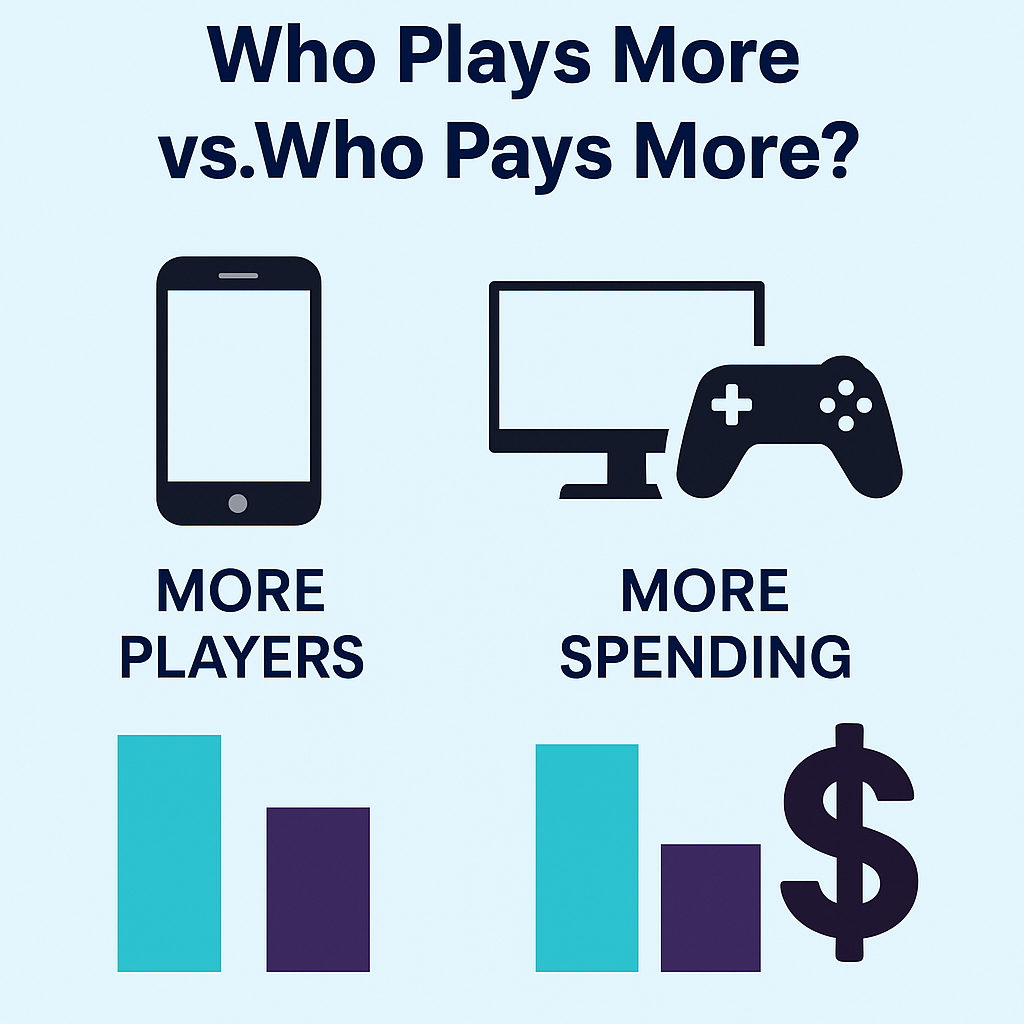

Mobile rules in player count, but deeper pockets and longer sessions belong to PC and console audiences. Here’s how spending power and playtime are shifting across platforms.

In 2025, more people than ever are gaming on phones, on consoles, and on PCs. But not all players spend equally. While mobile continues to dominate in global reach, the real money is flowing elsewhere.

According to Xsolla and industry analyses, PC and console gamers are historically more inclined to make larger individual purchases compared to mobile players.

These trends challenge the long-standing assumption that mobile’s sheer volume equals profitability. In fact, the deeper engagement and stronger purchasing behavior on traditional platforms may signal a rebalance in where developers and publishers place their bets.

So where do players really pay, and play, more? The answer lies in the data, and it’s more nuanced than you might think.

Platform Showdown: Mobile Wins Volume, PC and Console Win Value

Mobile gaming might dominate in downloads and daily active users, but when it comes to where the money is, PC and console platforms quietly lead the charge.

Mobile: The Casual Giant

Mobile games account for a significant portion of global gaming revenue. Industry estimates, including those cited by Xsolla, suggest this share is near, but not definitively at, 50%

Billions of people worldwide have access to a smartphone, and mobile titles like Subway Surfers or Clash of Clans can reach audiences in ways consoles never could.

But scale doesn’t always mean spend.

According to AppsFlyer data for Tier-1 Western markets, the average Day 90 ARPU (average revenue per user) for mid-core mobile games using hybrid monetization models sits at $9.69 on iOS and just $1.54 on Android.

In contrast, monetization based on in-app ads alone (IAA) lags behind, returning just $1.26 on iOS and $0.81 on Android. These numbers reflect how mobile monetization is often built on volume, not depth.

PC and Console: Fewer Players, Bigger Payouts

Despite having a smaller total user base, PC and console players are historically more willing to pay and they pay bigger.

Xsolla’s report highlights that PC and console players are more likely to pay for full-price games, downloadable content, and cosmetic upgrades compared to mobile players.

That’s a sharp contrast with just 20% of mobile players. Additionally, these players invest in full-price games, downloadable expansions, and cosmetic upgrades creating a more stable, high-value revenue stream for developers.

Time is Money: Longer Sessions, Fewer Days

PC and console gamers also exhibit deeper time-based engagement.

PC and console players typically engage in longer gaming sessions than mobile users, who play in shorter, more frequent bursts.

While they may play on fewer days per week, their sessions are longer and more immersive.

This kind of engagement creates stronger monetization opportunities whether through live-service models, downloadable content, or premium expansions.

From Microtransactions to Memberships: The Evolution of Monetization

How players pay is just as important as where they play. In 2025, the industry is witnessing a shift in monetization logic, from interruptive ad-based revenue to seamless, service-based ecosystems.

The Rise of Hybrid Models in Mobile

Mobile games have long relied on in-app purchases (IAPs) and in-app advertisements (IAAs) to generate revenue. But data shows a clear frontrunner: hybrid monetization, where both models are combined, is now the most effective.

AppsFlyer reports that hybrid monetization in mid-core mobile games achieves a D90 ARPU of $9.69 (iOS) and $1.54 (Android) outperforming pure IAP or IAA strategies.

It’s a delicate balance: let users play for free, but provide compelling reasons to pay, whether that’s through upgrades, cosmetic items, or content unlocks.

Still, these gains pale in comparison to the kind of single-transaction or bundled revenue found on PC and console.

PC and Console: Premium Content Still Holds Value

Whereas mobile often relies on monetizing volume, PC and console players are more open to upfront or bundled payments. Whether it’s a $70 AAA title, a $20 season pass, or a $10 skin pack, these transactions happen in ecosystems where players expect to pay.

This behavior fuels a more predictable revenue curve. Developers can plan around launch windows, content drops, or premium upgrades. It’s no surprise that console and PC players represent a more stable spending audience, as emphasized in the Xsolla Q1 2025 report.

Subscription Models Are Redrawing the Map

A quiet revolution is happening in mobile, too, and it’s led by some surprising players. Entertainment giants like Netflix, Apple, and Crunchyroll are now bundling mobile games into their subscription services, offering players ad-free experiences with no IAPs.

This trend signals a cultural shift: users are warming up to premium mobile experiences, especially when integrated into their broader digital ecosystem.

For developers, this could mean a better alignment between quality and monetization. For players, it means fewer interruptions and more freedom.

How Players Pay – Digital Wallets, Emerging Markets and the Future of Spend

The method of payment is no longer just a technicality, it’s a key factor in monetization success. As players across the world adopt new payment technologies and habits, game developers and publishers are racing to keep up.

Digital Wallets Are on the Rise

Global ecommerce trends are bleeding into gaming, and one of the most visible shifts is the rise of digital wallets. According to the Xsolla Q1 2025 report, digital wallets are expected to grow from 50% to 61% of all ecommerce transaction value between 2023 and 2027 , a compound annual growth rate (CAGR) of 14.9%.

Why it matters: These wallets make purchases faster, more secure, and more accessible, especially for younger gamers and players in regions with low traditional banking penetration.

Platforms like Apple Pay, Google Wallet, Paytm, and GrabPay are becoming the default options for many, particularly in mobile-first markets.

Regional Shifts: Emerging Markets Take Center Stage

Emerging markets are now leading the way in mobile monetization innovation. In regions such as India, Southeast Asia, and Latin America, mobile banking and digital wallets are far more popular than credit cards or traditional banking.

This changes how monetization strategies are built:

- Carrier billing and wallet disbursements outperform traditional payment models.

- Players prefer microtransactions in local currency.

- Mobile-first titles optimized for low-spec devices but with smart monetization perform best.

At the same time, PC and console still dominate in North America, Europe, Japan, and South Korea, where banking infrastructure supports larger, one-off purchases and long-term subscriptions.

Platform Loyalty vs. Payment Flexibility

Another trend: players are increasingly platform-agnostic when it comes to payment methods. Whether they’re on console, PC, or mobile, they expect unified, seamless payment experiences often tied to their preferred digital wallet or subscription bundle.

This reinforces the need for global payment strategies that are both localized and scalable.

Beyond the Numbers: Player Sentiment and Cultural Shifts in Gaming

Spending habits don’t exist in a vacuum. They’re shaped by how players feel about the games they play, the platforms they trust, and the value they perceive. In 2025, this emotional context is proving just as important as price tags and purchase funnels.

Gaming as Identity, Not Just Entertainment

For many players, especially Gen Z and Gen Alpha, gaming is a core part of personal identity. Communities form around titles, streamers, and in-game personas. Spending becomes an extension of that identity whether it’s a rare skin, a battle pass, or access to premium story content.

Platforms like Twitch, Discord, and TikTok have become cultural hubs for gamers, where sentiment around monetization is both vocal and contagious. If a game is seen as exploitative or overly aggressive with ads or paywalls, it quickly loses goodwill and players.

Many industry veterans argue that today’s players are more informed, more vocal, and less tolerant of exploitative monetization tactics like loot boxes.

The Subscription Shift Reflects a Cultural Rejection of FOMO

As subscription services gain ground, players are showing a preference for predictable, ad-free, and low-friction gaming experiences. This aligns with a broader cultural fatigue around FOMO (fear of missing out) mechanics limited-time offers, pay-to-win boosts, or forced daily logins.

- Apple Arcade, Netflix Games, and even Xbox Game Pass are leaning into this shift by promoting value over urgency.

- Games that focus on content quality, user choice, and ethical monetization see stronger long-term engagement.

This isn’t just good PR, it’s good business. Games that cultivate trust and respect player time and money are more likely to enjoy sustained revenue.

Time-Rich vs. Time-Poor Players

Another behavioral trend: players are increasingly divided into two camps, those who have more time than money, and those who have more money than time.

- Mobile gamers, often playing in short bursts, favor games that respect their limited attention.

- PC and console players, who carve out time for deeper sessions, show more willingness to invest in content-rich experiences.

Understanding this segmentation is key to designing monetization strategies that feel fair and flexible, rather than one-size-fits-all.

The Real Value Lies in Depth, Not Just Reach

In a world where gaming is everywhere, it’s easy to assume that the biggest audience equals the biggest opportunity. But the numbers tell a more nuanced story.

While mobile dominates in volume, the true economic power lies with PC and console players, who spend more per session, engage more deeply, and are increasingly drawn to quality-driven experiences.

From the rise of hybrid monetization models to the cultural rejection of exploitative mechanics, 2025 is shaping up to be a year of smarter, more intentional spending.

For developers, publishers, and platforms, the message is clear: growth is no longer just about more players, it’s about more value per player.

Where do you see the future of player spending going?

Is the age of ad-driven mobile dominance fading, or will emerging markets shift the balance again?